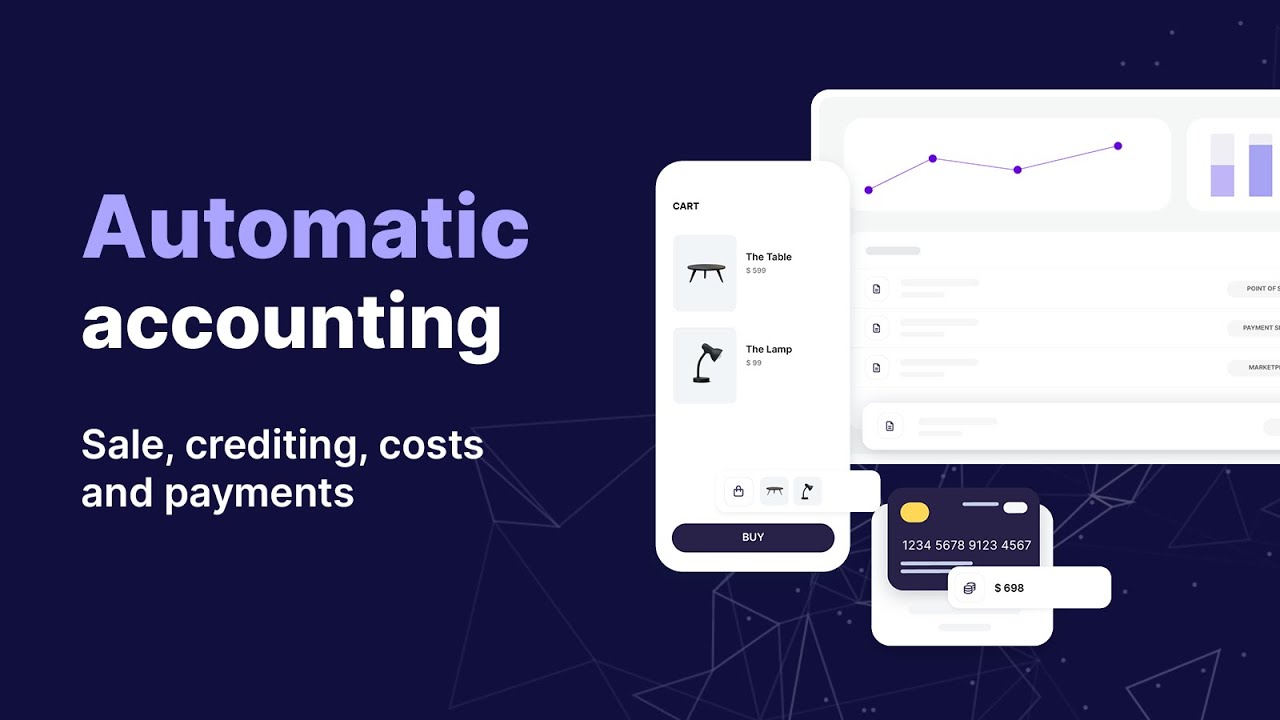

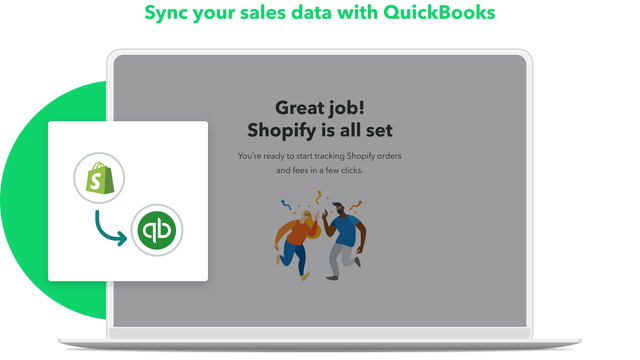

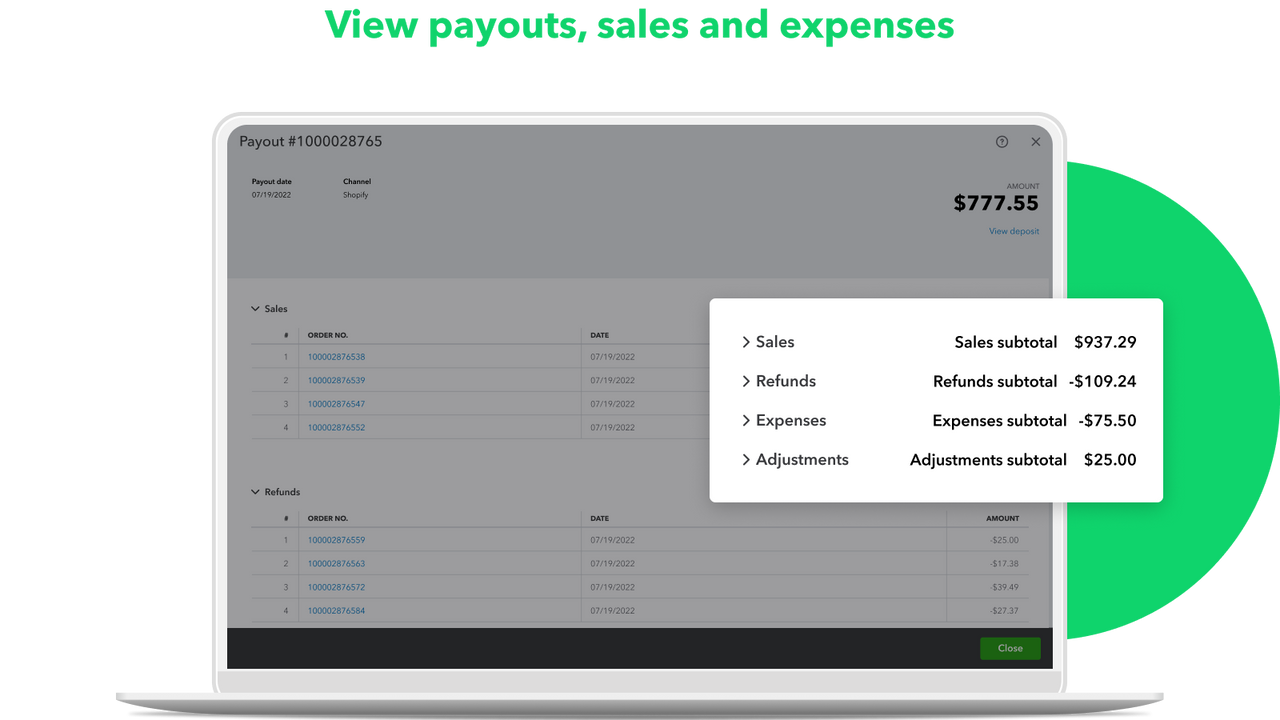

Effortlessly synchronize your Shopify store with a powerful accounting solution that uncovers financial insights. This integration allows for real-time data updates, ensuring accurate tracking of sales, expenses, and inventory.

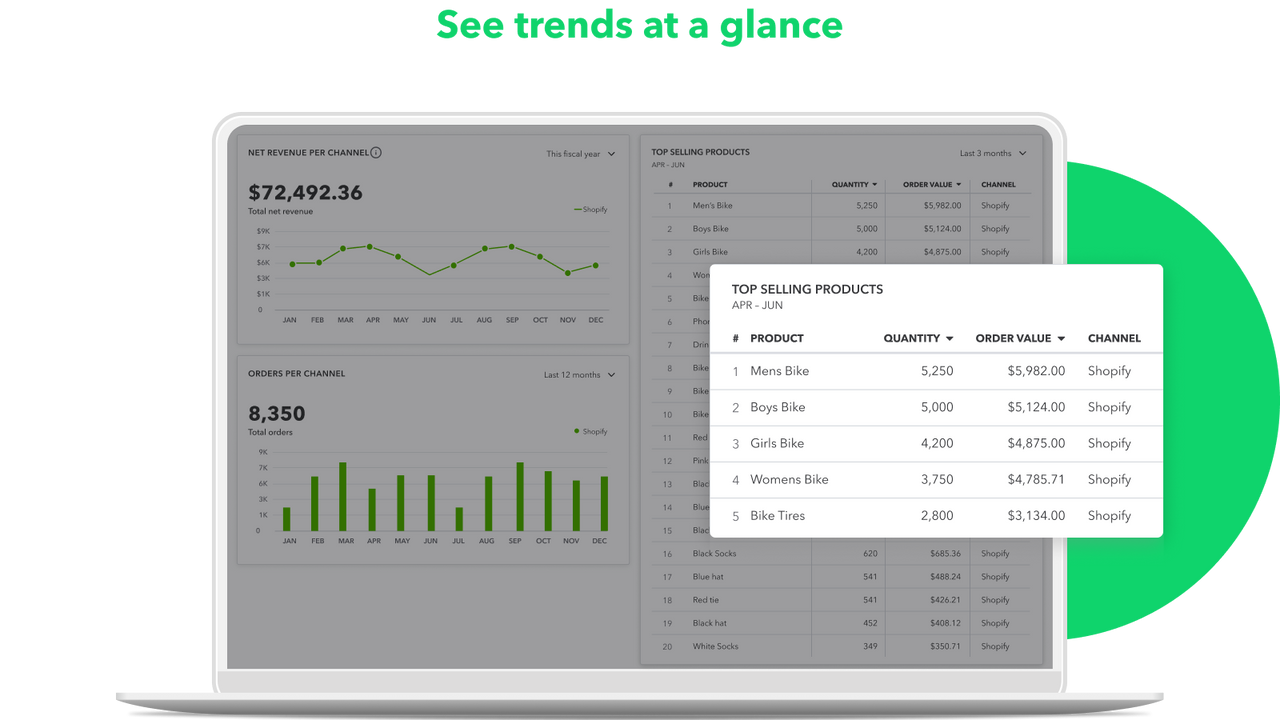

Leverage extensive reporting features that reveal spending trends and revenue flows, giving merchants the clarity needed for informed decision-making. With an intuitive dashboard, stay on top of your business's financial health without the complexity often associated with accounting software.

Automate mundane bookkeeping tasks, allowing more time to focus on growth strategies. Reduce human error with streamlined data entry and ensure compliance with financial standards. This solution is designed to elevate financial management efficiency, presenting every critical number at your fingertips.

Your Shopify store and accounting can coexist in harmony, enabling swift transactions and simplified financial oversight.

QuickBooks Online

QuickBooks Online Xero Bridge by Parex

Xero Bridge by Parex